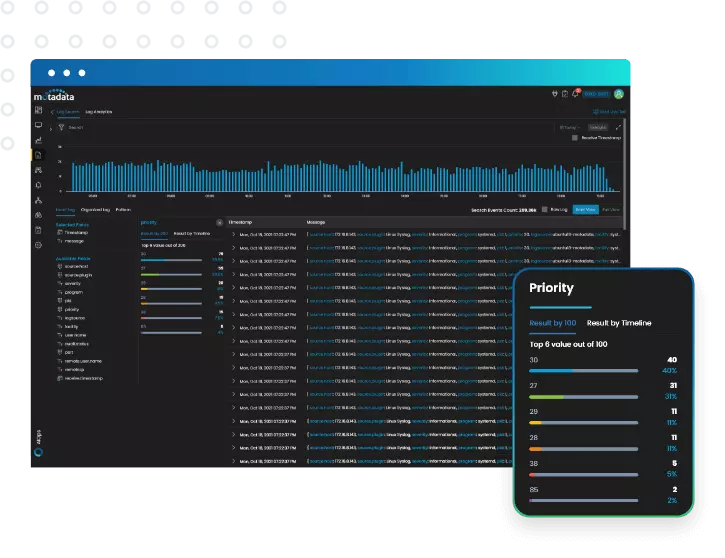

Cloud-Based Innovations in the Log Management Software Market

Financial analysis of the log management software market requires understanding diverse revenue streams and monetization models generating value for vendors across different market segments. The Log Management Software Market Revenue is generated through multiple mechanisms including software licensing, subscription fees, consumption-based pricing, and professional services. The Log Management Software Market size is projected to grow USD 5.776 Billion by 2035, exhibiting a CAGR of 6.44% during the forecast period 2025-2035. Understanding revenue drivers enables vendors to design sustainable business models and investors to evaluate financial potential. Financial analysis helps identify value concentration points and opportunities for market participants. Revenue patterns reflect the evolving transition from traditional licensing toward subscription and consumption-based models.

Subscription and software-as-a-service revenue represents the predominant and fastest-growing revenue stream for log management software vendors. Monthly or annual subscription fees provide predictable recurring revenue enabling sustained product investment. SaaS delivery eliminates customer infrastructure management while providing vendors ongoing customer relationships. Tiered subscription models offer different capability levels and usage limits at varying price points. Per-user pricing applies for solutions emphasizing analyst and operator access. Per-data-volume pricing charges based on log ingestion, storage, or processing quantities. Retention-based pricing tiers costs according to log data retention periods maintained. These subscription models are increasingly preferred by both vendors seeking recurring revenue and customers preferring operational expense approaches.

Perpetual licensing and on-premises revenue maintains significance for organizations requiring traditional deployment models. Perpetual license sales generate upfront revenue for on-premises software deployments. Annual maintenance and support fees provide recurring revenue for perpetual license customers. Capacity-based licensing scales pricing according to log volume, nodes monitored, or other capacity metrics. Enterprise licensing agreements provide comprehensive access across organizational boundaries. Upgrade revenue is generated when customers expand deployments or add functionality. These traditional licensing models remain relevant for customers with data sovereignty requirements or existing infrastructure investments.

Professional services and implementation revenue supplements software revenue through project-based engagements. Implementation services generate revenue through initial deployment, configuration, and integration activities. Custom development creates revenue for specialized integrations or extensions beyond standard functionality. Training services generate revenue while supporting customer success and product adoption. Managed services provide ongoing operational support for customers preferring outsourced administration. Consulting services provide strategic guidance on log management strategy and architecture. Migration services transition customers from legacy or competing solutions. These services revenues complement software revenue while building customer relationships and satisfaction.

Top Trending Reports -

Japan Smart Infrastructure Market Growth

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness