Vendor Management Software Market Dynamics, Future Trends & Regional Insights | 2035

Conducting a rigorous and insightful Vendor Management Software Market Competitive Analysis requires a multi-dimensional framework that goes far beyond a simple comparison of feature checklists. In this complex enterprise software market, a platform's true competitive strength is determined by a combination of its architectural approach, the breadth and depth of its functional modules, the quality of its user experience, and the strength of its ecosystem. A meaningful competitive analysis must dissect a vendor's offering across all these layers to understand its true value proposition and its suitability for different types of customers. A superficial analysis that just compares pricing and features will fail to capture the nuanced realities of why one platform succeeds over another in a competitive sales cycle. The evaluation must be holistic, considering the entire source-to-pay lifecycle and the total user experience.

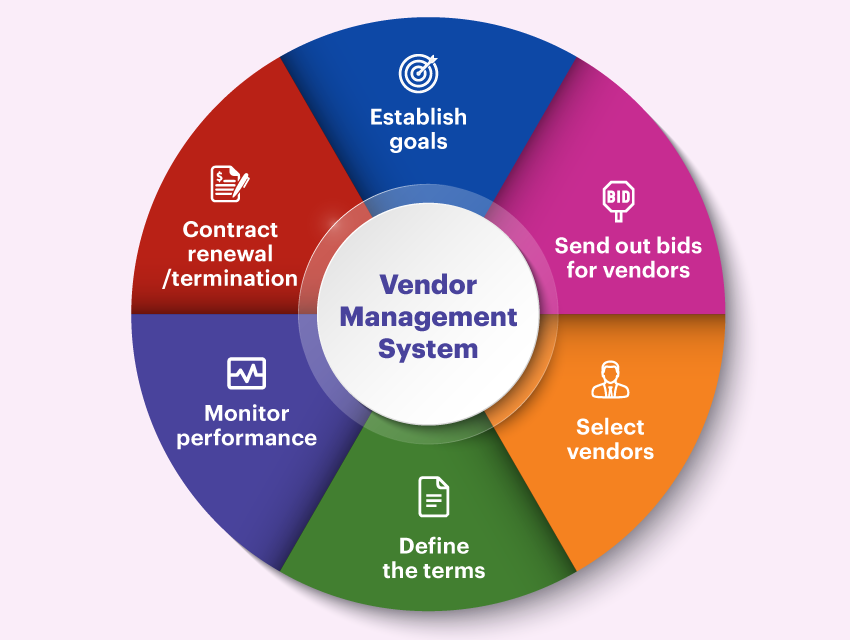

The first and most fundamental layer of a deep analysis is the platform's architecture and breadth. The key question here is whether the competitor offers a single, organically developed, unified platform, or if their suite is a collection of different products that have been acquired and loosely integrated. A unified platform generally offers a more seamless user experience, a more consistent data model, and lower administrative overhead. The analysis must also benchmark the breadth of the suite. Does the competitor have strong, native modules for all the key areas of the source-to-pay process, including sourcing, contract management, e-procurement, invoicing, payments, and risk management? A vendor with a more complete, end-to-end suite has a major advantage over one that has significant functional gaps and requires the customer to rely on third-party integrations for core capabilities.

The second, and increasingly critical, layer of analysis is the user experience (UX). The era of complex, hard-to-use enterprise software being forced upon employees is over. In the modern "consumerization of IT" world, a platform's adoption and ultimate success are heavily dependent on how easy and intuitive it is to use for all stakeholders, from procurement professionals to the individual employees who need to request a purchase. A competitive analysis must therefore involve a hands-on evaluation of the user interface. How many clicks does it take to complete a common task like creating a purchase requisition? Is the platform mobile-friendly? How good is its search functionality? A platform like Coupa, which has built its entire brand on a superior, "Amazon-like" user experience, has proven that UX can be a powerful and sustainable competitive differentiator. The third layer of analysis must be the strength of the vendor's ecosystem. This includes the size of their pre-built supplier network, the richness of their API and app marketplace for third-party integrations, and the quality of their global network of implementation partners. A strong ecosystem creates a powerful network effect and makes a platform much more valuable and "sticky." The Vendor Management Software Market size is projected to grow to USD 55.17 Billion by 2035, exhibiting a CAGR of 11.18% during the forecast period 2025-2035.

Top Trending Reports -

Industrial X Ray Inspection Equipment And Imaging Software Market

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness